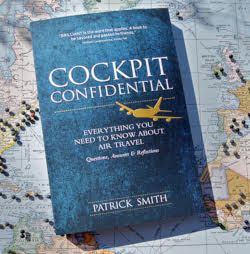

A “Life List” of Planes

Pages from “World Airline Fleets, 1980.” Author’s photo.

UPDATE: November 13, 2021

AIRLINER ENTHUSIASTS are like birdwatchers in a lot of ways. We dress funny and we tend to own expensive binoculars. And, we’re into lists.

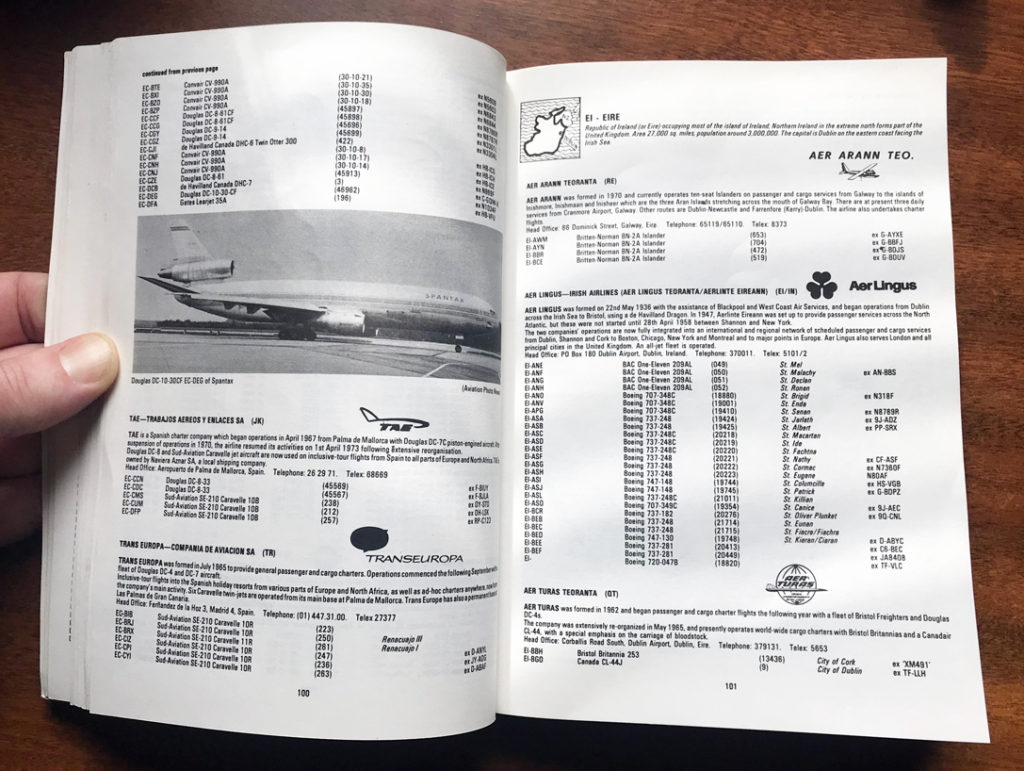

As I kid I was a planespotter. I’d spend entire weekends holed up in the 16th-floor observation deck at Logan Airport, logging the registration numbers of arriving and departing jets. There were books you could buy — annual global fleet directories with the registrations and specs of every commercial plane in the world, arranged alphabetically by country and airline. There were little boxes where you could check off each plane once it was “spotted,” or, you could just line through the listing with a highlighter. World Airline Fleets, I remember, was one of these books. It came from the U.K. and was edited by a fellow named Gunter Endres (who, the Interweb tells us, is still writing aviation books). An even bigger volume, published in Switzerland, was called J.P. Airline Fleets. The idea was to mark off as many planes as you could.

Up there on the 16th floor, things could get competitive. I’ll never forget the jealousy I felt toward a legendary Boston spotter named Barry Sobel, because he’d seen and recorded a Pakistan International 707 freighter that landed unexpectedly one weekday while I was in school.

At one point, way back when, I could have told you the model and airline of every commercial plane I’d ever seen. Birders have tallies like this, too. They call them “life lists.” Braniff DC-8, El Al 707, Aeroflot IL-62… check, check, check. There were hundreds. Somewhere along the way I stopped keeping track, and all these years later I couldn’t begin to reconstruct such a catalog.

What I can do, however, easily and accurately, is present a slightly different life list: a record of each airplane type, and each airline, that I have flown aboard. It appears below. I’ll also include which classes I’ve sat in, using the traditional industry codes:

F = First

C = Business

Y = Economy

The accompanying photo is from April, 1974. That’s my sister and me walking up the stairs to an American Airlines Boeing 727, on our way to Washington, D.C. This was the first airplane, large or small, that I ever set foot in. I’m fortunate to have the moment preserved like this.

Even then, at eight years-old, I knew it was a 727.

BOEING 727

American F,Y

Northwest F,Y

Eastern Y

Delta F,Y

Pan Am Y

TWA F,Y

USAir/US Airways Y

Trump Shuttle Y

Fawcett (Peru) Y

Aeroamericana (Peru) Y

DHL (cargo)

BOEING 707

TWA Y

BOEING 737 CLASSIC

Piedmont Y

USAir Y

United Y

Delta Y

Aloha Y

Rutaca (Venezuela) Y

Cayman Airways Y

Sky Airline (Chile) Y

PLUNA (Uruguay) Y

:

BOEING 737 (Next Generation)

American Y

United Y

Delta F,Y

Southwest Y

KLM Y

Malaysia Airlines Y

SAS Y

South African Airways Y

Jet Airways (India) C

Turkish Airlines Y

En route to Taipei on an Eva Air 777.

BOEING 747 (All series)

Pan Am Y

Northwest F,C,Y

El Al Y

United C

British Airways C,Y

Air France Y

Qantas Y

Singapore Airlines Y

Thai C

Delta C,Y

Korean Air F,C,Y

Royal Air Maroc Y

South African Airways Y

:

BOEING 757

Northwest Y

American F,Y

United F,Y

Delta F,C,Y

British Airways Y

Icelandair Y

BOEING 767

United F,C,Y

Delta F,C,Y

TWA C

All Nippon Y

Kenya Airways C

BOEING 777

United Y

American C

Delta C,Y

Emirates F,C,Y

Malaysia Airlines Y

Thai C,Y

Eva Air Y

Korean Air Y

Royal Brunei Y

Cathay Pacific C

Qatar Airways C

Singapore Airlines C

Jet Airways (India) F

China Eastern C

AeroSanta 727 at Cuzco, 1994. Author’s photo.

BOEING 787

Japan Airlines Y

Qatar Airways C

Virgin Atlantic C

Korean Air C

DOUGLAS DC-8

Air Canada Y

DHL (cargo)

McDONNELL DOUGLAS DC-9 (Classic)

Northwest Y

USAir Y

Delta F,Y

Air Canada Y

Finnair Y

Aeropostal (Venezuela) Y

ValuJet Y

McDONNELL DOUGLAS MD-80 Series (DC-9 Super 80, MD-88/83/87, etc.)

TWA F,Y

Delta F,Y

American F,Y

New York Air Y

Continental F

Austral (Argentina) Y

McDONNELL DOUGLAS MD-90 Series (MD-90, Boeing 717)

Delta F,Y

Bangkok Airways Y

Uni Air (Eva Air) Y

McDONNELL DOUGLAS DC-10

American F,Y

Northwest F,C,Y

Aeromexico Y

Finnair Y

British Airways C

Continental Y

McDONNELL DOUGLAS MD-11

Delta C,Y

Boarding a DC-10 in Bermuda, 1979. Author’s photo.

LOCKHEED L-1011

Eastern F,Y

Pan Am Y

Delta Y

FOKKER F-28

USAir Y

AIRBUS A300

Eastern Y

American Y

Thai Y

DHL (cargo)

AIRBUS A310

Lufthansa Y

AIRBUS A320 Series (A319, A320, A321)

United F,Y

Delta F,Y

America West F

US Airways Y

British Airways Y

Air France Y

Lufthansa Y

TAP Y

Royal Brunei Y

Air Malta C

SAETA (Ecuador) Y

LanPeru Y

AirAsia Y

JetBlue Y, C

China Eastern F

Drukair (Royal Bhutan Airlines) C

Avianca C

VietJet Y

Qatar Airways C

South African Airways Y

AIRBUS A330

Air France Y

Sabena Y

Delta C,Y

Cathay Pacific C,Y

Thai Y

Asiana C

Singapore Airlines C

Turkish Airlines C

China Airlines C

Philippine Airlines C

Qatar Airways C

South African Airways C

On board a China Airlines A350. Author’s photo.

AIRBUS A340

Air France C,Y

EgyptAir Y

SriLankan Y

Cathay Pacific Y

China Airlines Y

Qatar Airways C

AIRBUS A350

Qatar Airways C

China Airlines C

Cathay Pacific C

Delta C

Thai Airways C

Qatar Airways C

AIRBUS A380

Emirates F,C

Qatar Airways C

Asiana C

AIRBUS A220 (Bombardier C-Series)

Delta F,Y

airBaltic Y

EMBRAER 190

JetBlue Y

American Y

US Airways Y

Aerorepublica (Colombia) Y

EMBRAER 190

JetBlue Y

American Y

US Airways Y

Aerorepublica (Colombia) Y

TUPOLEV Tu-134

Aeroflot Y

TUPOLEV Tu-154

Aeroflot Y

As you’ve probably noticed, I’ve left out regional jets and turboprops. Partly because they’re boring, and partly because, for that same reason, I can’t remember them all. Highlights would include a Pan Am Express Dash-7, an Air New England FH-227, an Aeroperlas (Panama) Shorts 360, and a cargo-carrying Twin Otter in which I sat on the floor during a hop from St. Croix to San Juan.

The winners, if we can call them that, are the 737 and A320, predictably enough. That’s not very exciting, which makes it pleasing to see the 747 coming in third place. Somehow I’ve managed to fly aboard 747s from 13 different carriers.

Northwest Airlines, some of you might recall, was the launch customer for the 747-400, back in 1989. That spring, they had been using the jet on domestic “proving runs” mainly between Minneapolis and Phoenix. Finally on June 1st, they inaugurated international service. The first departure was flight NW 47, from JFK to Narita. My friend Ben and I were passengers on that flight. It was the day after my 23rd birthday. I still have one of the commemorative sake cups that they handed out.

Of all the planes that ought to be on the list, but aren’t, the most painful example is the Concorde. Years ago, when I was a regional airline pilot, British Airways used to offer a special “interline” Concorde fare to London, available only to industry employees. It cost $400, and it was what we call “positive-space” — as opposed to standby. A remarkable bargain, looking back on it. But when you’re a young pilot making twenty grand a year, $400 is a lot of money, and so I kept putting it off, putting it off. I’ll do it later, I promised myself. Next year.

And then it was gone.